Here is download link for this MS Excel Sheet to help you plan your Bi-Weekly Budget.

FREE EXCEL BUDGET TEMPLATE FOR MAC FREE

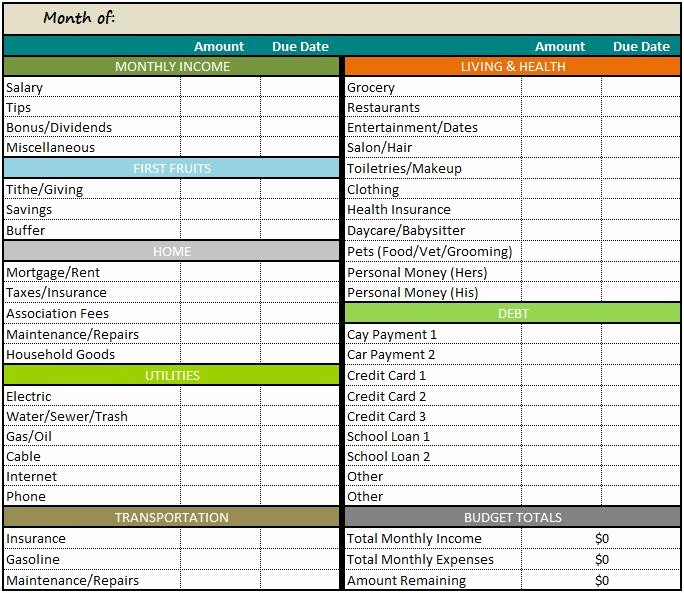

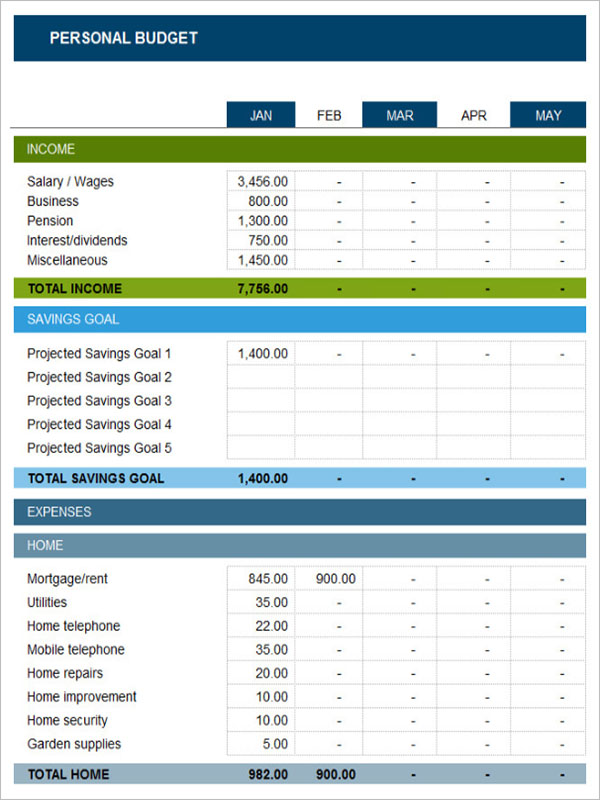

Here is download link for this 2nd Free & Exclusive Bi-Weekly Budget Template in MS Excel format.Īnd here comes the 3rd Exclusive Bi-Weekly Budget Template in MS Excel.ĭownload this wonderful Free Excel Template.Ĭheckout following simple yet comprehensive Bi-Weekly as well as Monthly Budget Planner Template. Please click on the button bellow to start downloading this MS Excel Template. Here comes the first of these Bi-Weekly Budget Templates in MS Excel. Please send us your feedback by posting a comment on this post as how we can improve it you serve your purpose. We have created some Bi-Weekly Budget Templates based upon user feedback to facilitate our websites users in planning their Bi-Weekly Budgets effectively. Bi-Weekly Budget Templates (Exclusive But Free) This way when you have this certain amount of money in your account, you can spend the remaining funds in your hand without worrying about going dry or out of money in between the bi-weekly payments. this is not a healthy practice and you should decide on a particular amount of money that should be there in your account at all times. When you have paid all of your bills and you know there is no more expense, it is very hard not to see how much money you have got in your account that you can spend on things you like i.e. Creating a Buffer in your Savings Account: For example, if you are paid $200 a week, you should save at least $40 in your emergency account. Creating an Emergency Fund:Īnother healthy exercise is to put a portion of your paycheck in some kind of savings account. This means that you will pay the bills with each paycheck. With this tactic, you need to pay the bills as soon they arrive. When you want to adjust your bi-weekly budget, the most important and first thing is to forget that you are paid twice a month and you receive the bills once a month.

Useful Tips for Handling Problems with Bi-weekly Budget: Adopting a Schedule with Bi-week Income: Usually when they pay their bills and make other expenses, they find out that there is not enough money in their account to survive for the next 15 days before the next paycheck arrives. This is yet another very common problem with the people who receive paychecks twice a month. When you are paid two times a month and you have to pay your bills only once a month, it can create a big problem for you because when you pay your bills and assume that you have paid all the bills and now you can relax until next paycheck comes, what will happen if another bill arrives the next day and you have no money to pay for it. Being failed with Developing regular Bill Payments: Usually when a person receives three checks in a month, they think that this is an extra income and they can spend it anyway they want but it’s not right. This can happen twice or three times in the entire year when you will have an extra check in your hands.

When you are paid twice a month, you will receive three pay checks every year every now and then. Pitfalls to avoid with Bi-weekly Budget: Assuming the Extra Check as a Reward: In order to eliminate any problems and financial situations, you need to develop a bi-weekly budget plan.

In the situation when you are paid twice a month but you only need to pay your bill once each month, it can create a problem for you. It is different from the traditional regular salary basis where the employees are paid only once in every month. This is also known as bi-weekly salary basis where a company or organization pays its employees two times a month. It is very common in many countries around the world where the employees and workers are paid twice a month.

0 kommentar(er)

0 kommentar(er)